Company Description

Intel designs, manufactures,

and markets high-performance microprocessor units (MPUs) and related chips for

the PC market. We believe Intel sells approximately 80% of MPUs in the PC

market and that it has the ability to establish standards in the PC market,

given its dominant position.

Valuation

We rate INTC Outperform. We

believe the current strength in the industry's fundamentals should continue to

attract investors. In our view, the seasonal uptick in PC demand (typical for

the second half of any given year) has combined with strength in the communications,

internet infrastructure, and digital consumer end markets to cause overall

semiconductor demand to accelerate. Our 12-month target price of $95 assumes

that Intel would be fairly valued at a 10% premium to the market multiple

(based on our 2000 EPS estimate for Intel and consensus estimates for the

S&P Industrials). In our view, INTC is suitable for investors with a

tolerance for the price volatility associated with technology stocks.

Key Investment

Positives

• Tailored

MPU'products for market segments. Intel developed MPUs to

address the major segments of the PC market, ranging from Celeron for low-cost

PCs up to Xeon for the high-performance server and workstation segments.

Intel's next generation Pentium-111 MPU was officially introduced on February

26, 1999. We expect the company to transition the desktop PC, notebook PC, and

server markets to the Pentium-111 family in the second half of this year.

Pentium Ill-enabled PCs have been launched at aggressive price points, which

has offered improved price/ performance for end-users — particularly for

Internet applications using today's modems. Since the Pentium-111 die is only

slightly larger than Pentium-11's, we expect Pentium-Ill to ultimately obsolete

the Pentium-11 during the next several quarters.

• We believe Intel's

competitive advantage is its ability to establish and drive PC technology and

standards. In our view, the company has successfully shifted the PC architecture

in its favor by developing new industry standards to enhance system performance

and functionality. Intel's ability to establish standards for the PC market

gives us confidence that the company can sustain its competitive advantage.

• We believe

Intel is the strongest semiconductor manufacturing company in the world today. Despite the delay

in the introduction of the 0.18-micron versions of its Pentium 111

microprocessors, we maintain our belief that Intel's leading-edge manufacturing

capabilities enable the company to introduce faster, more feature rich MPU

solutions ahead of its competitors. The company's ability to continue to

introduce more performance at its segmented MPU price points has kept its

overall ASP (average selling price) from declining. In retrospect, the company

found that its internal goal to ramp its 0.18-micron process technology was

simply too aggressive.

• Acquisitions

aimed at expanding Intel's presence in the networking and telecommunications

market segments. In August 1999, Intel acquired Level One

Communications. Level One is a major supplier of mixed-signal communications

ICs for Ethernet, Fast Ethernet and Gigabit

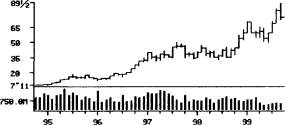

Intel Stock Price

History

Monthly

Ethernet for networking, and WAN technologies

for the telecommunications markets. We believe the acquisition is strategic and

will compliment Intel's current networking product portfolio. In July 1999,

Intel acquired Dialogic, which provides open standard hardware and software

solutions for voice and data networking. This acquisition is aimed at expanding

Intel's server business in the networking and telecommunications market

segments. In September 1999, Intel agreed to acquire the Telecom Component

Products division of Stanford Communications. This division possesses some of

the key semiconductor building blocks required to participate in the broadband

cable and wireless markets. Intel should become a more significant player

within the rapidly emerging cable modem, digital

cable set-top box,

cable head-end, LMDS, and MMDS markets.

Key Investment

Risks

• Paradigm

shift could force change in business model.

As with any large, entrenched company, there

is the risk of a major shift that enables new competition or changes the way in

which systems are designed. Intel's operating model is based on shipping large

quantities ofhigh-ASP microprocessors that fund massive manufacturing

developments. If the overall PC market were to shift decisively toward the

network computer or low-cost PCs, dramatically reducing microprocessor ASPs,

the company would need to make significant changes in its business model, which

could adversely affect its financial strength.